The Great Depression was the most severe economic crisis in American history, lasting roughly from 1929 to 1941. During this period, the United States experienced unprecedented levels of unemployment, poverty, and social upheaval that transformed American society and government. Understanding the causes and effects of this crisis is crucial for grasping how the American economy and government evolved in the 20th century.

Economic Background

America was changing from a farming economy to an industrial one dominated by big businesses. This shift created new problems that would contribute to the Depression. While cities and some industries boomed during the 1920s, farmers and rural areas were already struggling long before the stock market crash.

The economic conditions before the Depression included:

- The "Roaring Twenties" featured uneven prosperity, with some industries and urban areas booming while agriculture and rural areas struggled

- Wealth inequality increased dramatically, with the richest 1% of Americans controlling approximately 40% of the nation's wealth

- Consumer purchasing power couldn't keep pace with productive capacity, creating economic imbalances

- The financial system lacked adequate regulation and stability mechanisms

Causes of the Great Depression

The Depression wasn't caused by just one thing, but by several problems happening at the same time. These issues fed into each other, making the economic collapse much worse than any previous downturn in American history. The problems ranged from too many goods being produced to risky stock market gambling to banks making bad loans.

Overproduction

- Industries and farms produced more goods than consumers could afford to purchase

- Agricultural sector had been overproducing since the end of World War I when European farms resumed production

- Manufacturing capacity expanded beyond sustainable market demand

Stock Market Speculation

- Stock prices rose dramatically throughout the 1920s, creating a speculative bubble

- Many investors bought stocks "on margin," paying as little as 10% down and borrowing the rest

- When the market began to fall, investors received "margin calls" forcing them to sell stocks, driving prices down further

- The stock market crashed on "Black Tuesday," October 29, 1929, with the Dow Jones losing nearly 25% of its value in two days

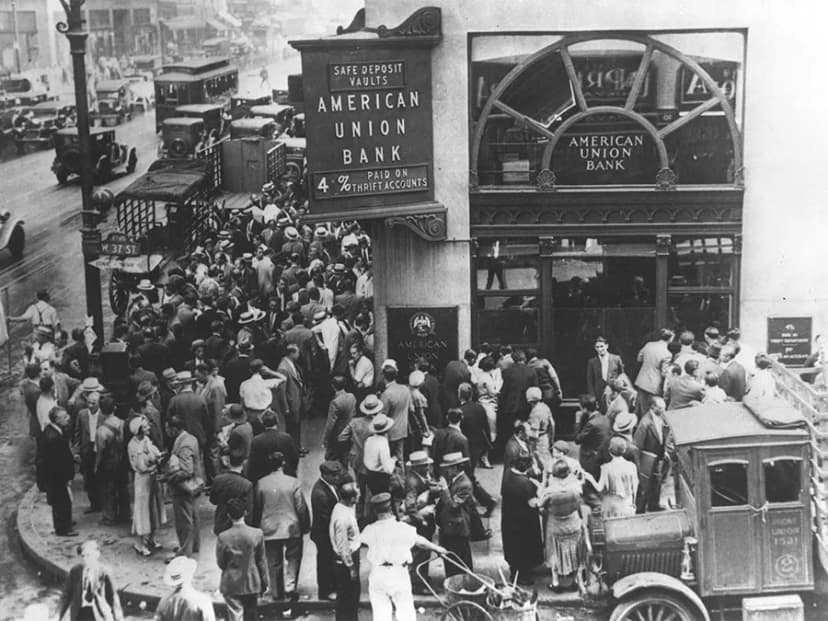

Banking System Failures

- Banks made risky loans during the 1920s with little oversight

- When economic conditions deteriorated, many loans defaulted

- "Bank runs" occurred as depositors rushed to withdraw their savings

- By 1933, thousands of banks had failed, wiping out the savings of millions of Americans

- The Federal Reserve failed to act as a "lender of last resort," tightening money supply instead of expanding it

Reduction in Consumer Spending

- As unemployment rose, consumers had less money to spend

- Businesses cut production and laid off more workers in response

- This created a devastating economic cycle that drove the economy deeper into depression

Depth and Impact of the Depression

The Depression affected nearly every part of American life and was far worse than any economic downturn before or since. Millions lost their jobs, homes, and savings. Many Americans went hungry, and some became homeless, living in shantytowns nicknamed "Hoovervilles" after President Herbert Hoover.

The economic collapse affected virtually every aspect of American life:

- Unemployment reached approximately 25% by 1933 (compared to 3-4% before the crash)

- Industrial production fell by nearly 45% between 1929 and 1932

- The national income dropped by more than 50%

- Homelessness increased dramatically, with makeshift settlements called "Hoovervilles" appearing across the country

- Farmers were hit by both the economic crisis and environmental disaster when the Dust Bowl devastated the Great Plains

The Dust Bowl

On top of the economic crisis, a terrible environmental disaster struck America's farmland. Years of poor farming practices combined with severe drought turned the Great Plains into a "Dust Bowl." Massive dust storms destroyed farms and forced thousands of families to abandon their homes and seek work elsewhere.

Environmental catastrophe compounded economic hardship:

- Severe drought combined with decades of inappropriate farming techniques

- Massive dust storms swept across the Great Plains from 1930-1936

- Thousands of families, especially in Oklahoma, Texas, and Kansas, lost their farms

- Many migrated to California and other western states, becoming known as "Okies"

- The environmental disaster highlighted the need for sustainable agricultural practices

Hoover's Response

President Herbert Hoover tried to address the Depression but his efforts were too limited. He believed in self-help and worried that too much government assistance would make people dependent. As conditions worsened, Americans grew increasingly frustrated with what they saw as Hoover's lack of action.

President Herbert Hoover's approach to the crisis reflected traditional Republican values but proved inadequate:

- Initially believed the Depression would be short-lived and self-correcting

- Resisted direct federal relief to individuals, believing it would weaken American self-reliance

- Created the Reconstruction Finance Corporation (RFC) to provide loans to banks and businesses

- Supported the Federal Home Loan Bank Act to help prevent home foreclosures

- Signed the Hawley-Smoot Tariff, which raised import duties to protect American industries but triggered retaliatory tariffs from other nations, further reducing international trade

- Encouraged voluntary cooperation among businesses to maintain wages and employment

Public Reaction to Hoover

As the Depression worsened, people became angry with President Hoover. Many Americans felt he wasn't doing enough to help ordinary people who were suffering. This anger showed in the nickname "Hoovervilles" for homeless camps and in protests like the Bonus Army march on Washington.

As conditions worsened, Americans grew increasingly frustrated with Hoover's limited response:

- Homeless encampments mockingly named "Hoovervilles" appeared in cities nationwide

- The "Bonus Army" of World War I veterans marched on Washington in 1932, demanding early payment of service bonuses

- When some veterans refused to leave, Hoover ordered the army to clear their encampment, creating a public relations disaster

- Hoover became a symbol of government indifference, though historians now recognize he did more than his predecessors would have done

Election of 1932

The 1932 election represented a turning point in American politics. Franklin D. Roosevelt won by promising a "New Deal" to help Americans suffering from the Depression. His victory signaled that voters wanted the government to take a more active role in addressing economic problems.

The economic crisis transformed American politics:

- Democrat Franklin D. Roosevelt won the presidency in a landslide, promising a "New Deal" for the American people

- During his inaugural address in March 1933, FDR famously declared that "the only thing we have to fear is fear itself"

- Roosevelt's election marked the beginning of a significant shift in the role of the federal government in American society

- His First Hundred Days featured unprecedented legislative action to address the crisis

Lasting Impact

The Great Depression completely changed how Americans viewed the government's role in the economy. Before the crisis, most people thought the government should stay out of economic matters. After experiencing the Depression, many Americans supported a more active government that would provide a safety net during hard times and regulate the economy to prevent future crises.

The Great Depression fundamentally altered Americans' expectations of government. Before the crisis, most Americans believed economic problems should be addressed by individuals, private charity, or local government. By 1932, with traditional approaches failing, voters were ready to accept a more active federal government. This shift would profoundly influence American politics and society throughout the remainder of the 20th century.

Vocabulary

The following words are mentioned explicitly in the College Board Course and Exam Description for this topic.

| Term | Definition |

|---|---|

| American liberalism | A political ideology emphasizing government intervention in the economy and society to promote social welfare and individual rights. |

| credit instability | Periods of uncertainty and volatility in the availability and terms of borrowed money in the financial system. |

| financial regulatory system | Government institutions and rules designed to oversee and control banking and financial markets to prevent crises. |

| Great Depression | A severe economic crisis in the 1930s characterized by widespread unemployment, falling prices, and reduced consumer spending that had profound effects on the U.S. economy and society. |

| industrial economy | An economy based on manufacturing and large-scale production of goods by factories and corporations. |

| market instability | Periods of significant fluctuation and uncertainty in stock prices and financial markets. |

| mass unemployment | Widespread joblessness affecting a large portion of the working population. |

| rural economy | An economy centered on farming and the production of crops and livestock. |

| urban economy | An economy based in cities and centered on industrial and commercial activities. |

| welfare state | A system in which the government provides social and economic support programs to its citizens. |

Frequently Asked Questions

What actually caused the Great Depression to happen?

Short answer: there wasn’t one single cause—the Great Depression was the result of several linked problems that turned a 1929 stock-market collapse into a decade-long economic crisis. Longstanding weaknesses (unequal income, overproduction in factories and farms, heavy consumer credit) created a speculative bubble. The stock-market crash (Black Tuesday, Oct. 29, 1929) popped that bubble and wiped out wealth, but the slump became a depression because banks failed (many bank runs), the Federal Reserve tightened money instead of easing it (monetary contraction), and international trade fell after tariffs like Smoot-Hawley worsened global demand. Environmental disaster (the Dust Bowl) deepened farm collapse. Hoover’s limited federal relief and the RFC couldn’t stop the downturn; Franklin D. Roosevelt’s New Deal (WPA, Social Security, AAA) later expanded federal intervention to stabilize the economy. For APUSH, be ready to explain multiple causes, connect cause → effect, and use specific examples (CED keywords)—see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and practice questions (https://library.fiveable.me/practice/ap-us-history).

Why did the stock market crash in 1929 lead to such a huge economic disaster?

The crash of 1929 triggered disaster because it wasn’t just one bad day—it exposed and amplified underlying weaknesses. Stocks had been wildly overvalued by speculation and margin buying; when prices fell, investors lost huge wealth quickly. That wiped out consumer confidence and spending, so businesses cut production and laid off workers. Bank failures and runs followed as panicked depositors withdrew savings; with many banks gone, credit dried up and businesses couldn’t get loans. The Federal Reserve’s monetary contraction made the credit squeeze worse, and international shocks (like falling trade after Smoot-Hawley) deepened the slump. Together these shocks turned a financial crash into mass unemployment, farm hardship (Dust Bowl added strain), and long economic collapse—exactly the kinds of causes/effects you need to explain for AP Topic 7.9 (Learning Objective J). For a focused review, see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr). Practice more with AP-style questions at (https://library.fiveable.me/practice/ap-us-history).

What's the difference between the stock market crash and the actual Great Depression?

The stock market crash (Oct. 1929, “Black Tuesday”) was a sudden collapse in share prices after a speculative bubble popped. It wiped out paper wealth and shook public confidence. The Great Depression, though, was the much longer, deeper economic crisis of the 1930s: mass unemployment, business collapse, bank failures, and severe drops in output and prices. Why they’re different: the crash was a sharp financial shock and visible symbol; the Depression was the sustained economic collapse that followed. The crash helped trigger the Depression, but other structural causes made it far worse: bank runs and failures, Federal Reserve monetary contraction, overproduction and weak consumer demand, international problems like the Smoot-Hawley tariff, and environmental disasters (Dust Bowl) that deepened rural distress (CED keywords). On the AP exam you should be able to explain both immediate triggers and broader causes/effects (Topic 7.9 LOJ). For a focused review, see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and try practice questions (https://library.fiveable.me/practice/ap-us-history).

How did the Great Depression affect regular people's daily lives?

Everyday life during the Great Depression changed radically: by 1933 unemployment hit ~25%, so many people lost steady paychecks and savings after bank failures and runs. Daily realities: long breadlines and soup kitchens, families doubling up in tiny apartments or living in shantytowns called “Hoovervilles,” and widespread evictions. Rural life was worse where the Dust Bowl ruined farms—thousands of tenant farmers and sharecroppers migrated west to California looking for work. Kids left school or worked; malnutrition and illness rose because medical care and incomes fell. Men’s and women’s roles shifted (women sometimes kept families afloat by taking domestic or factory jobs). Government responses (Reconstruction Finance Corporation, FDR’s New Deal programs like WPA and Social Security) began to reshape relief and work by providing jobs, cash benefits, and financial regulation. For AP exam answers, tie these daily effects to causes (stock market crash, bank failures, Fed contraction, Smoot-Hawley) and to New Deal policy changes (Topic 7.9; see Fiveable study guide: https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr).

What was life like during the Great Depression for families?

For families the Great Depression meant sudden and sustained hardship: unemployment peaked around 25% by 1933, many lost savings in bank failures and couldn’t pay mortgages, and homelessness and shantytown communities called “Hoovervilles” appeared. Daily life shifted—diets shrank, children left school to work, birthrates fell, and families often split up as people migrated looking for work (Dust Bowl migrants from the Plains moved to California). Rural farmers faced low prices; the Dust Bowl made farming impossible for many, pushing migration and reliance on federal relief. Hoover’s limited response gave way to FDR’s New Deal programs (Reconstruction Finance Corporation, WPA jobs, Agricultural Adjustment Act, Social Security Act) that provided jobs, cash relief, and long-term safety nets. For AP prep, be ready to use these specifics (unemployment rates, Dust Bowl migration, New Deal policies) as evidence and to contextualize causes and effects in DBQs/LEQs (see the Topic 7.9 study guide: https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr). For extra practice, try questions at https://library.fiveable.me/practice/ap-us-history.

I'm confused about how banks failing made everything worse during the Great Depression - can someone explain?

When thousands of banks failed after 1929, it made the Depression much worse through a vicious feedback loop. Bank runs wiped out people's savings, so households cut spending. With less consumer demand and banks unwilling or unable to lend, businesses couldn’t get credit to operate or expand—so they laid off workers. Rising unemployment further reduced demand, causing more business failures and more loan defaults. The Federal Reserve’s monetary contraction (it didn’t inject enough liquidity) deepened the credit squeeze. Hoover’s limited responses led to creation of things like the Reconstruction Finance Corporation late in the crisis, and FDR’s New Deal later aimed to stabilize banks and restore confidence (FDIC, banking reforms). For APUSH, this ties directly to causes/effects in Topic 7.9 and KC-7.1.I.C—review the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and practice questions (https://library.fiveable.me/practice/ap-us-history).

What were the main effects of the Great Depression on the American economy?

The Great Depression wrecked the U.S. economy in several clear ways. After the 1929 stock-market crash and speculative bubble burst, investment and consumer spending collapsed, industrial output fell sharply, and unemployment soared to about 25%. Bank failures and runs wiped out savings and tightened credit (the Federal Reserve’s monetary contraction worsened this), which further reduced demand. International trade plunged partly because of the Smoot-Hawley tariff. Farmers suffered from price collapse and environmental disasters (the Dust Bowl), causing mass rural poverty and migration. The crisis exposed weaknesses in financial regulation and prompted major policy responses: Hoover’s Reconstruction Finance Corporation and, more decisively, FDR’s New Deal programs (WPA, AAA, Social Security Act) that created a limited welfare state and new financial safeguards. For AP exam evidence and practice, use the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr), review Unit 7 (https://library.fiveable.me/ap-us-history/unit-7), and drill practice questions (https://library.fiveable.me/practice/ap-us-history).

How did the Great Depression change the role of the federal government in people's lives?

The Great Depression massively expanded federal power and responsibility in everyday life. Shocked by bank failures, mass unemployment, and market collapse, policymakers under Hoover and especially FDR created new federal programs and regulators: the Reconstruction Finance Corporation, bank reforms (FDIC, SEC), the New Deal agencies (WPA, CCC), agricultural programs (AAA), and the Social Security Act (1935). That transformed the U.S. into a limited welfare state—people now expected federal relief, unemployment/old-age insurance, public-works jobs, and active economic management (monetary and fiscal policy). It also redefined modern liberalism and led to lasting expectations that the federal government would stabilize the economy and protect citizens from extreme risk. For AP review, focus on cause → policy response → long-term change (use the Topic 7.9 study guide: https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr). For practice, try problems at (https://library.fiveable.me/practice/ap-us-history).

What specific policies did FDR create to deal with the Great Depression?

FDR responded with a wide set of New Deal policies to stabilize finance, provide relief, and reform the economy. Key moves: a national Banking Holiday and the Emergency Banking Act plus Glass-Steagall (separating commercial and investment banking) and FDIC insurance to stop bank runs; the SEC to regulate the stock market. Relief and jobs programs included the CCC (work camps), TVA (regional development), WPA (large public-works employment), and federal support for farmers via the AAA. The NIRA/NRA tried to manage industry and wages (later struck down). Major reform: the Social Security Act (1935) creating old-age insurance and unemployment benefits; the Wagner Act strengthened labor rights. These transformed the U.S. into a limited welfare state and reshaped federal power—exactly the kinds of causes/effects AP questions ask about (CED Topic 7.9). For a focused review, see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr). Practice questions: (https://library.fiveable.me/practice/ap-us-history).

How do I write a DBQ essay about the causes and effects of the Great Depression?

Start with a clear thesis that answers “how and why” the Great Depression happened and what its major effects were (economic collapse → policy transformation). Contextualize briefly—1920s credit expansion, stock speculation, agricultural strain, and weak global trade after WWI. Use at least four documents to support claims (identify Stock Market Crash/Black Tuesday, bank failures/bank runs, Federal Reserve contraction, Smoot-Hawley tariff, Dust Bowl, Hoover vs. FDR responses). For two documents, analyze POV/purpose (e.g., Hoover administration memo vs. New Deal speech). Bring one piece of outside evidence beyond the docs (Reconstruction Finance Corporation, WPA, Social Security Act, or Federal Reserve policy). Show complexity by explaining multiple causes (financial—speculation and Fed policy; structural—uneven income, agriculture; international—tariffs) and linking them to effects (mass unemployment, welfare state/New Deal reforms). Follow DBQ rules: thesis, contextualization, use ≥4 docs, cite extra evidence, source two docs, and aim for complex understanding. For a focused review, see Fiveable’s Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and practice questions (https://library.fiveable.me/practice/ap-us-history).

Did the Great Depression actually end because of World War II or New Deal programs?

Short answer: both, but in different ways. New Deal programs (FDIC/bank reforms, Reconstruction Finance-type relief, AAA, WPA, Social Security) stabilized banking, created a limited welfare state, and reduced some poverty and hardship—shifting expectations about federal responsibility (CED KC-7.1.III; keywords: Works Progress Administration, Social Security Act, Agricultural Adjustment Act). However, the economy didn’t fully recover: unemployment peaked near 25% in 1933 and remained high through the late 1930s. World War II’s massive mobilization finally ended mass unemployment by creating wartime production and defense jobs, pushing GDP and industrial output far above pre-Depression levels. So New Deal softened and reformed the economy and provided lasting institutions, while WWII’s demand produced the full output and employment recovery. For AP exam prep, you’ll want to analyze both causation and continuity/change (use examples like WPA and wartime mobilization)—see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and more unit review (https://library.fiveable.me/ap-us-history/unit-7). Practice FRQs and multiple-choice at (https://library.fiveable.me/practice/ap-us-history).

What's the connection between the Great Depression and the rise of the welfare state?

The Great Depression’s scale—mass unemployment, bank failures, collapsing farms, and widespread poverty—shattered faith in laissez-faire and forced policymakers to act. The crisis created political pressure for federal relief, jobs programs, and economic regulation, so FDR’s New Deal built a “limited welfare state”: Social Security (1935) provided pensions/unemployment insurance; the Works Progress Administration created millions of jobs; the Agricultural Adjustment Act paid farmers to reduce production; the Reconstruction Finance Corporation and banking reforms strengthened the financial system. Those policies redefined modern American liberalism by accepting a federal role in social welfare and stabilizing the economy (CED KC-7.1.III). For AP exam evidence and phrasing, use those specific laws and programs when contextualizing or supporting a DBQ/LEQ; the Topic 7.9 study guide has concise summaries (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr). For extra practice, check unit review (https://library.fiveable.me/ap-us-history/unit-7) and 1000+ practice problems (https://library.fiveable.me/practice/ap-us-history).

Why didn't the government do more to prevent the Great Depression from happening?

Short answer: they tried some things, but a mix of limited knowledge, ideology, and bad policy made prevention unlikely. In 1929 most policymakers didn’t fully grasp macroeconomics (no Keynesian consensus yet) and the federal government favored limited intervention and voluntarism under Hoover. Structural problems—an unregulated, fragmented banking system, heavy household and corporate debt, and speculative stock bubbles—meant shocks propagated fast. The Federal Reserve tightened money in 1929–33 (monetary contraction) and failed to stop bank runs, which deepened the downturn. Protectionist moves like the Smoot-Hawley Tariff worsened trade collapses. When Hoover did act, measures (Reconstruction Finance Corporation, limited relief) were too small and too late; larger federal responses came only under FDR’s New Deal. For AP review, focus on causes (stock market crash, bank failures, Fed policy, Smoot-Hawley, Dust Bowl) and effects (unemployment, New Deal reforms) as required by Topic 7.9 (Learning Objective J). See the topic study guide for a compact review (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and try practice questions (https://library.fiveable.me/practice/ap-us-history).

How did the Great Depression lead to stronger financial regulations?

The Great Depression exposed how fragile U.S. finance was: the 1929 stock market crash, widespread bank runs and thousands of bank failures, and a Federal Reserve monetary contraction destroyed savings and credit. That crisis created public demand for rules to prevent repeats. Policymakers (FDR/New Deal) responded with major regulatory reforms: the Banking Act of 1933 (Glass–Steagall) separated commercial and investment banking and created the FDIC to insure deposits and stop runs; the Securities Act of 1933 and the SEC (1934) regulated stock issuance and trading to curb speculation; and later reforms strengthened Fed supervision and created the Reconstruction Finance Corporation’s earlier model of federal intervention. On the AP exam, connect these reforms to causes (speculation, bank failures) and effects (restored confidence, expanded federal role in the economy) in DBQs/LEQs. For a concise review, see the Topic 7.9 study guide (https://library.fiveable.me/ap-us-history/unit-7/great-depression/study-guide/hI7MOeaEZFK45NrnWkxr) and practice questions (https://library.fiveable.me/practice/ap-us-history).