There are a variety of costs associated with unanticipated inflation. Unanticipated inflation is a surprise, meaning that consumers and producers were not given time to adjust in advance. Remember that inflation is a general rise in prices. Economists will make predictions about possible inflation rates based on the current state of our economy however there are times when their predictions are not accurate. As a result of the change between predictions and what the inflation rate actually is there are costs that result. These costs include menu costs, shoe-leather costs, loss of purchasing power, and redistribution of wealth.

Costs of Inflation

Menu costs result from a firm having to change prices. As inflation occurs within our economy, businesses are forced to change any business-related materials that have prices on them like a menu as a result. An example of this would be Walmart having to hire additional workers to replace all the price tags on their products every week. Another example is the owner of a restaurant having to spend an extra three hours a week creating and updating coupons.

Shoe leather costs refer to the cost of time and effort that people end up spending to counteract the effects of inflation. For example, businesses may hold less cash or have to make additional trips to the bank during inflation. A good example of this is each month your rent increases so you can't set up an online automatic payment and as a result, have to pay cash and deliver the rent in-person to your landlord.

Loss of purchasing power occurs because inflation causes the value of the individual dollar to decrease over time. For example, individuals who have the same wage next year as they do currently will not be able to purchase as much. For example, if an individual earns a salary of $60,000 and the inflation rate rises from 3% to 5% from 2018 to 2019 than that salary will not be able to purchase as much in 2019 as it was in 2018.

Wealth redistribution involves the real value of wealth being transferred from one group to another. (i.e. borrowers and lenders). When people are considering lending or borrowing money, they will take into consideration the expected inflation rate. If that inflation rate turns out to be different than anticipated, that affects the amount of interest that is repaid or earned.

Who Is Helped By Unanticipated Inflation?

While many think that inflation is universally bad, unanticipated inflation actually helps people at times. Here are a few people who may be helped by inflation:

- Borrowers with fixed interest rates: Unanticipated inflation can benefit borrowers with fixed interest rates because it can reduce the real value of the debt. For example, consider a borrower who takes out a loan with a fixed interest rate of 5% per year. If the inflation rate is unexpectedly high and exceeds 5%, the real value of the debt will decline, effectively reducing the burden of the debt. Borrowers with variable interest rates, on the other hand, may not benefit from unanticipated inflation because their interest rates may increase to compensate for the higher inflation.- Owners of assets: Unanticipated inflation can also benefit owners of assets, such as real estate or stocks, because it can increase the nominal value of their assets. For example, if the inflation rate is unexpectedly high, the nominal value of an asset may increase even if its real value does not change. This can lead to higher profits for asset owners.- Firms that can cut real wages: Unanticipated inflation can also benefit firms that can cut real wages, as it can allow them to reduce the nominal wages of their workers without reducing their purchasing power. For example, if a firm is facing rising costs due to unanticipated inflation, it may be able to reduce the nominal wages of its workers while maintaining their purchasing power by adjusting for the higher inflation rate. This can help the firm reduce its labor costs and improve its competitiveness.

It's important to note that moderate inflation is actually considered a good thing for the economy! Moderate inflation incentivises spending because prices will be higher later. If we knew that prices were going to decrease, we wouldn't spend now, we'd wait.

Who is Hurt By Unanticipated Inflation?

- Savers: Unanticipated inflation can erode the purchasing power of savings, as the money saved loses value over time due to rising prices. This can be particularly detrimental to those who rely on their savings for long-term financial stability, such as retirees. To protect against the effects of inflation, savers may invest in assets that are expected to increase in value at a rate that is higher than the inflation rate. These may include assets such as stocks, real estate, or certain types of bonds. Savers may also consider adjusting their saving strategies to account for the impact of inflation on the real value of their savings.

2. Workers on fixed incomes: People who receive a fixed income, such as those on a pension or disability benefits, may find it difficult to keep up with rising prices if their income does not increase at the same rate as inflation. This can lead to a decline in their standard of living.

3. Borrowers with variable rates: Unanticipated inflation can also have negative effects on borrowers if their rates are variable. This is because inflation will lead lenders to increase interest rates to pay for the costs of inflation.

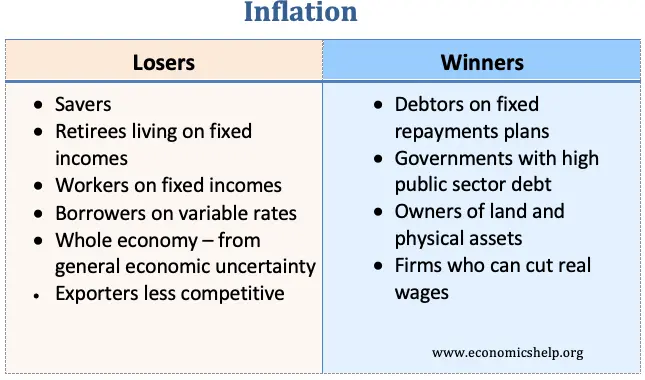

Here's a chart that summarizes some of the material we've covered:

Vocabulary

The following words are mentioned explicitly in the College Board Course and Exam Description for this topic.

| Term | Definition |

|---|---|

| borrowers | Individuals or entities that demand loanable funds by taking loans in the loanable funds market. |

| deflation | A sustained decrease in the general price level of goods and services in an economy over time. |

| lenders | Individuals or institutions that provide money or credit to borrowers with the expectation of repayment, often with interest. |

| unexpected inflation | A rise in the general price level of goods and services that occurs contrary to what individuals and businesses anticipated, causing economic disruption. |

| wealth redistribution | The transfer of economic resources or purchasing power from one group of individuals to another, often as an unintended consequence of economic changes. |

Frequently Asked Questions

What are the main costs of inflation that I need to know for the AP exam?

Know these AP-tested costs of unexpected inflation/deflation (CED MEA-1.H): - Redistribution of wealth: unexpected inflation transfers real wealth from lenders to borrowers because the real interest rate falls (Fisher idea: real ≈ nominal − expected inflation). - Uncertainty & price-level variability: makes planning, investment, and long-term contracts harder. - Menu costs: firms spend resources changing prices. - Shoe-leather costs: people make more trips to the bank or use less cash to avoid holding depreciating money. - Inflation tax: high inflation erodes real value of cash balances, acting like a tax on money holders. - Tax bracket creep: nominal-income increases push taxpayers into higher brackets unless brackets are indexed. - Wage contracts & indexation problems: fixed wages hurt workers under unexpected inflation; indexation reduces but doesn’t eliminate problems. These are fair game on both multiple-choice and free-response (Unit 2). Review examples and practice questions on the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and more unit review/practice (https://library.fiveable.me/ap-macroeconomics/unit-2, https://library.fiveable.me/practice/ap-macroeconomics).

How does unexpected inflation redistribute wealth between lenders and borrowers?

Unexpected inflation redistributes wealth because it lowers the real interest rate borrowers pay and raises the real cost to lenders. Use the Fisher relationship: real interest ≈ nominal interest − inflation. If a lender and borrower agree on a nominal rate assuming 2% inflation but inflation turns out to be 5%, the real rate is 3 percentage points lower than expected—borrowers repay with dollars that buy less, so borrowers gain and lenders lose. The reverse happens with unexpected deflation: lenders gain, borrowers lose. Contracts with indexation (wages, loan terms) protect against this, and uncertainty raises costs like menu and shoe-leather costs. This is exactly the redistributive effect described in EK MEA-1.H.1—it’s a common AP macro topic, so review the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and practice problems (https://library.fiveable.me/practice/ap-macroeconomics) for examples you might see on the exam.

What's the difference between expected and unexpected inflation costs?

Expected inflation is already built into contracts, prices, and interest rates, so its costs are mostly predictable and avoidable—lenders charge higher nominal interest to keep the real interest rate stable (Fisher equation), wages and bonds are often indexed, and people plan for menu/shoe-leather costs. Unexpected inflation, by contrast, creates the big redistributive and uncertainty costs CED MEA-1.H highlights: it arbitrarily transfers wealth (e.g., from lenders to borrowers when actual inflation > expected because the real interest rate falls), breaks fixed-wage contracts, increases price-level variability, and raises inflation uncertainty (harder to plan investment). It also causes unanticipated tax effects (bracket creep) and reduces the real value of cash balances (an “inflation tax”). For more review tied to the AP curriculum, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x). Practice these distinctions for free-response and multiple-choice items (unit overview: https://library.fiveable.me/ap-macroeconomics/unit-2).

I don't understand why inflation hurts people on fixed incomes - can someone explain?

If you’re on a fixed income (like a pension or set bond payment), inflation hurts because your nominal income doesn’t change while prices rise—so your real purchasing power falls. Example: if you get $1,000 a month and inflation is 5%, things that used to cost $100 now cost $105, so your $1,000 buys less. That’s the redistributive effect the CED highlights: unexpected inflation arbitrarily hurts people receiving fixed nominal payments and can benefit borrowers (because real interest falls). Indexation (cost-of-living adjustments) can protect fixed-income recipients, but many payments aren’t indexed. On the AP, be ready to explain this using “nominal vs. real” language and the Fisher idea that unexpected inflation changes real returns. For a quick review and examples, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and try practice questions (https://library.fiveable.me/practice/ap-macroeconomics).

Does inflation always hurt savers and help people with debt?

Not always. The AP CED point is that unexpected inflation redistributes wealth arbitrarily (lenders → borrowers) because it lowers the real interest rate = nominal rate − inflation (Fisher equation). If inflation is higher than expected, borrowers pay back with dollars worth less in real terms, so debtors gain and lenders lose. But when inflation is fully anticipated or contracts are indexed, savers aren’t necessarily hurt: nominal interest rates usually rise to compensate, and indexation or adjustable-rate loans protect lenders. Other factors matter too—fixed-rate vs. variable-rate debt, wage contracts, tax bracket creep, and uncertainty. Deflation flips the risk (hurts borrowers). For the AP exam focus on unexpected vs. expected inflation, real vs. nominal interest rates, and redistributive effects (MEA-1.H). Review Topic 2.5 on Fiveable (study guide: https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and try practice problems (https://library.fiveable.me/practice/ap-macroeconomics).

What happens to real wages when there's unexpected inflation?

If inflation is unexpected and nominal wages are fixed (wage contracts or sticky wages), real wages fall—workers’ purchasing power drops because their dollar wage buys fewer goods and services. Example: if your nominal wage is $20/hr and inflation unexpectedly jumps 5%, your real wage falls by about 5% (you’d need $21/ hr to keep the same real purchasing power). That arbitrary redistribution is exactly what the CED highlights: unexpected inflation redistributes wealth (lenders → borrowers, and employers → workers if wages aren’t adjusted) (EK MEA-1.H.1). If wages are indexed or renegotiated quickly, real wages won’t fall as much. For AP exam framing, mention sticky nominal wages, indexation, and the effect on real wages when explaining costs of unexpected inflation. For a quick review, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and more practice problems (https://library.fiveable.me/practice/ap-macroeconomics).

How do I explain the shoe leather costs of inflation in an FRQ?

Shoe-leather costs: define it quickly, explain the mechanism, give a short example, and link to redistributive effects—that’s what graders want on an FRQ. Example FRQ answer (concise): Shoe-leather costs are the resource costs people incur to avoid holding cash when inflation is high. When unexpected inflation rises, people make more trips to the bank, use more time and transportation, and shift to interest-bearing accounts or short-term securities. This increases transaction time and opportunity cost (time that could be used productively) and reduces real wealth held as cash. For example, a worker who makes daily bank withdrawals instead of holding cash spends extra time and gas, lowering real income. Tie it to CED terms: shoe-leather costs are a form of menu/shoe-leather costs caused by inflation uncertainty and show how unexpected inflation redistributes wealth and raises transaction costs (MEA-1.H; keywords: unexpected inflation, inflation uncertainty, shoe-leather costs). For more review and AP-style practice, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and Unit 2 resources (https://library.fiveable.me/ap-macroeconomics/unit-2). Practice thousands of FRQ-style questions here: (https://library.fiveable.me/practice/ap-macroeconomics).

Why is deflation also bad for the economy if lower prices sound good?

Lower prices sound nice, but deflation can hurt the economy. With deflation (negative inflation) the Fisher equation (real ≈ nominal − inflation) means real interest rates rise. Example: if the nominal rate is 3% and prices fall 2%, the real rate is about 5%—borrowing gets more expensive in real terms, so borrowers (households, firms) suffer while lenders gain (redistributive effects, EK MEA-1.H.1). Deflation also raises real wages when nominal wages are sticky (wage contracts), which can force firms to cut hiring → higher unemployment. Other costs: price-level variability increases uncertainty, menu costs and shoe-leather costs still matter, and debt burdens grow, worsening recessions. The AP exam expects you to explain these redistributive and macro effects (MEA-1.H). For a quick review, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and practice problems (https://library.fiveable.me/practice/ap-macroeconomics).

I'm confused about how inflation affects different groups differently - help?

Think of unexpected inflation like a surprise that changes who's richer or poorer. If lenders expect 2% inflation and set a nominal interest rate of 6%, the expected real interest rate is 4% (Fisher relation). If actual inflation turns out to be 5%, the real interest rate falls to 1% (6% − 5%), so borrowers gain and lenders lose—inflation arbitrarily redistributes wealth (CED MEA-1.H). Deflation does the opposite. Other costs: menu costs (firms changing prices), shoe-leather costs (people making more trips to bank), inflation tax (real value of cash falls), and tax-bracket creep (nominal incomes push you into higher brackets unless brackets are indexed). Wage contracts matter: without indexation, real wages fall when inflation is higher than expected. For exam prep, be ready to explain these redistributive effects and compute real vs nominal rates on FRQs (see Topic 2.5 study guide) (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x). Practice problems are at (https://library.fiveable.me/practice/ap-macroeconomics).

How does hyperinflation destroy an economy's ability to function?

Hyperinflation undermines an economy’s ability to function by wrecking money’s three roles: unit of account, store of value, and medium of exchange. Prices change so fast that contracts and price signals break down (price-level variability), so firms face huge menu costs and consumers make frequent trips to the bank (shoe-leather costs). Real interest rates become unpredictable—lenders lose when inflation outpaces nominal rates (Fisher equation), which collapses credit markets and investment. Savings and wages lose value (redistributive effects), causing capital flight, tax-bracket creep, and widespread avoidance of formal markets (more barter and black-market activity). Financial intermediation fails, output falls, and unemployment rises as firms can’t plan. For AP exam terms, link these to unexpected inflation, inflation tax, wage contracts, and indexation (see the Topic 2.5 study guide for concise review: https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x). Want practice Qs on this? Try the AP Macro practice bank (https://library.fiveable.me/practice/ap-macroeconomics).

What's the connection between inflation and economic efficiency losses?

Inflation reduces economic efficiency in several concrete ways. Unexpected inflation redistributes wealth (lenders → borrowers) by changing the real interest rate: if nominal rates don’t fully adjust (Fisher relation), lenders earn lower real returns—this is the EK MEA-1.H point on the CED. Inflation also creates price-level variability and uncertainty that raises the economy’s risk premium, discouraging investment and misallocating capital (fewer productive projects = efficiency loss). Other direct efficiency costs: menu costs (firms spend resources frequently changing prices), shoe-leather costs (people spend time/effort avoiding holding cash), inflation tax and tax-bracket creep (real increases in taxable income distort behavior), and costly renegotiation of wage contracts. Put together, these effects divert resources from productive uses and reduce GDP relative to a low-inflation benchmark. For AP review, see the Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and practice problems (https://library.fiveable.me/practice/ap-macroeconomics).

Can you give me real world examples of how inflation redistributes wealth?

Unexpected inflation redistributes wealth because it changes real interest rates and the real value of fixed contracts. Examples: - Lenders vs. borrowers: If you have a fixed-rate loan with a 3% nominal interest rate but inflation unexpectedly jumps to 5%, the real interest rate = 3% − 5% = −2%. Borrowers win (they repay with cheaper dollars); lenders lose (they get less purchasing power). (CED: MEA-1.H, Fisher equation) - Savers on fixed deposits: High unexpected inflation erodes the real value of bank deposits, so retirees with fixed savings lose. - Workers with fixed nominal wages: If wages don’t keep up with inflation, real wages fall and workers lose purchasing power; those with indexed contracts avoid this. - Government debt: Unexpected inflation reduces the real burden of preexisting nominal government debt, effectively transferring wealth from creditors to the government. For AP exam practice, you should be able to compute real vs. nominal rates and explain redistribution (see the Topic 2.5 study guide) (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x). More practice problems: (https://library.fiveable.me/practice/ap-macroeconomics).

How do I analyze the winners and losers from unexpected inflation?

Unexpected inflation redistributes wealth because the real interest rate = nominal rate − inflation (Fisher equation). Example: if a loan has a 5% nominal rate but inflation turns out to be 7% (unexpected), the lender gets a −2% real return and the borrower effectively pays less in real terms—borrowers win, lenders lose. Other winners: debtors, owners of real assets (houses, land) whose nominal prices rise. Losers: savers and fixed-income recipients (pensioners) whose real purchasing power falls, workers with fixed wage contracts, and anyone facing tax-bracket creep (paying higher taxes on inflation-driven nominal gains). Economywide costs include menu costs, shoe-leather costs, inflation tax on cash balances, and greater uncertainty that reduces efficient investment. On the AP, connect this to MEA-1.H (redistributive effects) and use the Topic 2.5 study guide for examples and practice (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x). For more practice, try problems at https://library.fiveable.me/practice/ap-macroeconomics.

What are the psychological costs of inflation that might show up on the test?

Psychological costs are about how people feel and behave when inflation is unexpected. Key effects you should know for the exam (use CED terms like unexpected inflation, inflation uncertainty, and money illusion): - Loss of confidence in money and the economy: people worry about future prices, so consumption and investment decisions become cautious or short-term. - Increased uncertainty about contracts and savings: lenders, savers, and fixed-income workers fear being arbitrarily hurt by inflation (redistributive effects from lenders to borrowers—EK MEA-1.H.1). - Money illusion and wage dissatisfaction: workers may misinterpret nominal pay increases as real gains, leading to morale problems and push for higher nominal wages or indexation in contracts. - Planning and investment decline: firms delay long-term projects because future real returns are unclear (reduces investment spending). - Behavioral costs like more frequent price checks or cash withdrawals (shoe-leather style behavior driven by worry). These show up on MCQs or FRQs linking inflation expectations, real vs nominal interest rates, and redistribution. Review Topic 2.5 study guide (https://library.fiveable.me/ap-macroeconomics/unit-2/costs-inflation/study-guide/pJfdbi0NXuslu8AN473x) and unit resources (https://library.fiveable.me/ap-macroeconomics/unit-2). For practice, try problems at (https://library.fiveable.me/practice/ap-macroeconomics).