Monte Carlo methods are powerful tools for solving complex problems through random sampling. They're used in finance, physics, and optimization, relying on the law of large numbers to approximate solutions that would be difficult or impossible to calculate directly.

These techniques shine when dealing with multi-dimensional problems or systems with many variables. As you increase the number of samples, the accuracy of Monte Carlo simulations typically improves, making them versatile for both deterministic and probabilistic challenges.

Monte Carlo Simulation

Fundamentals and Applications

- Monte Carlo simulation uses repeated random sampling to obtain numerical results and solve complex problems

- Named after Monte Carlo Casino in Monaco due to similarity with games of chance

- Relies on law of large numbers stating sample mean converges to expected value as sample size increases

- Applied in risk analysis, option pricing (finance), particle physics, and optimization problems

- Particularly useful for multi-dimensional integrals and complex systems with many coupled degrees of freedom

- Accuracy typically improves as square root of number of samples, following central limit theorem

- Versatile tools in probability and statistics used for both deterministic and probabilistic problems

Theoretical Foundations

- Based on law of large numbers principle

- Accuracy improves with increased sample size, following relationship where n is number of samples

- Central limit theorem underpins convergence of Monte Carlo estimates to true values

- Relies on ability to generate high-quality random or pseudorandom numbers

- Can be used to approximate complex integrals and solve differential equations

- Bayesian inference often employs Monte Carlo methods for posterior distribution sampling

- Convergence rate affected by dimensionality of problem (curse of dimensionality)

Random Sample Generation

Pseudorandom Number Generators (PRNGs)

- Algorithms producing number sequences approximating properties of random numbers

- Linear congruential generator defined by recurrence relation

- Mersenne Twister widely used for long period and high-quality randomness

- Xorshift generators offer fast, high-quality pseudorandom number generation

- Cryptographically secure PRNGs used for applications requiring unpredictability

- Seed value initializes PRNG sequence, allowing reproducibility of results

- Quality of PRNG assessed through statistical tests (Diehard tests, TestU01)

Sampling Techniques

- Inverse transform sampling uses cumulative distribution function to generate samples

- Rejection sampling draws from complex distributions using proposal distribution and acceptance criterion

- Box-Muller transform efficiently generates pairs of independent, standard normal random numbers

- Markov Chain Monte Carlo (MCMC) methods sample from complex, high-dimensional distributions

- Gibbs sampling, a special case of MCMC, used for multivariate distributions

- Slice sampling provides an alternative MCMC method for generating samples

- Importance sampling technique for sampling from difficult distributions by using a proposal distribution

Monte Carlo Estimation

Probability and Expectation Estimation

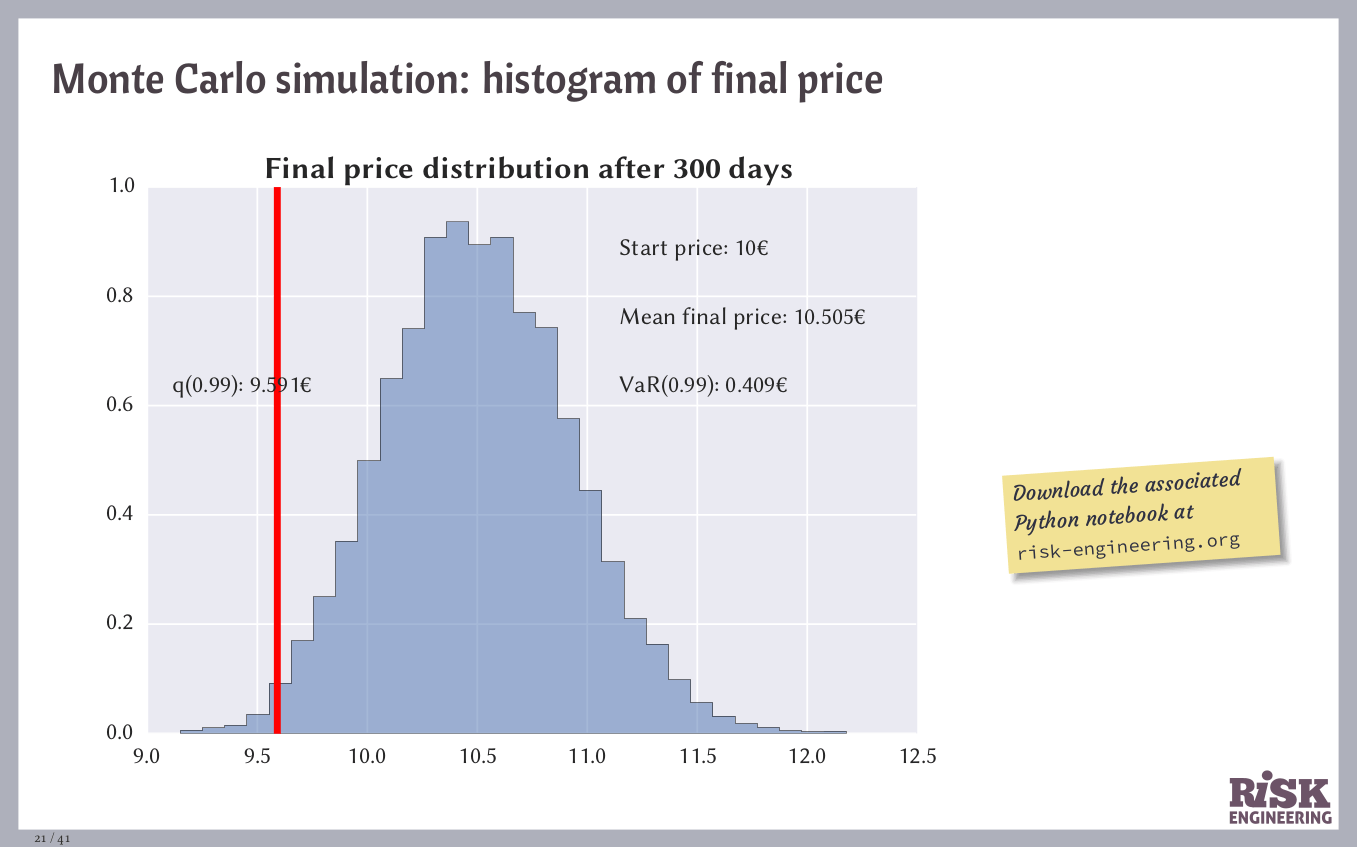

- Estimate probability by generating random samples and counting proportion satisfying event of interest

- Expected values estimated by averaging large number of random samples from distribution

- Law of large numbers ensures convergence of estimates to true values as sample size increases

- Importance sampling reduces variance in estimation of rare events

- Monte Carlo integration approximates definite integrals, especially in high-dimensional spaces

- Bootstrapping estimates sampling distribution of statistic and calculates confidence intervals

- Particle filters (Sequential Monte Carlo) estimate state in non-linear, non-Gaussian dynamic systems

Optimization and Simulation

- Simulated annealing uses Monte Carlo methods for global optimization problems

- Genetic algorithms employ Monte Carlo techniques in evolutionary computation

- Monte Carlo tree search used in game theory and artificial intelligence (AlphaGo)

- Quantum Monte Carlo methods simulate quantum many-body systems

- Agent-based modeling uses Monte Carlo simulation for complex adaptive systems

- Metropolis algorithm simulates systems in statistical mechanics

- Cross-entropy method optimizes rare event probabilities and combinatorial optimization

Monte Carlo Accuracy vs Precision

Error Estimation and Confidence Intervals

- Standard error of Monte Carlo estimate proportional to where n is number of samples

- Confidence intervals constructed using central limit theorem or bootstrapping techniques

- Batch means method estimates variance in presence of autocorrelation

- Jackknife resampling technique provides bias-corrected estimates

- Asymptotic normality of estimates allows for normal approximation in large samples

- Effective sample size (ESS) accounts for autocorrelation in Markov Chain Monte Carlo

- Gelman-Rubin diagnostic assesses convergence of multiple MCMC chains

Variance Reduction and Convergence Techniques

- Antithetic variates reduce variance by introducing negative correlation between samples

- Control variates improve efficiency by exploiting correlation with known quantities

- Stratified sampling divides sample space into non-overlapping strata for independent sampling

- Quasi-Monte Carlo methods use low-discrepancy sequences for improved convergence

- Adaptive Monte Carlo methods adjust simulation parameters to improve efficiency

- Multilevel Monte Carlo reduces computational complexity in stochastic differential equations

- Russian roulette and splitting techniques manage particle population in particle transport simulations