How Much Student Debt is Too Much?

5 min read•Last Updated on July 11, 2024

How Do Student Loans Work?

Student debt seems like a looming threat 😱 You hear it in the news, jokes amongst your friends, and more. Learning more about student loans (and debt) can help you make informed decisions about what types of loans to take out, how much you should be taking out in student loans, how much the average debt is, and how to get rid of student debts (assuming student loan forgiveness isn't coming any time soon). There is no magic number for the "right" amount of student debt, but by learning about student loans and calculating your different options, you can plan for your future.

Pro Tip: If you're feeling overwhelmed about college costs and applying for financial aid, remember to take care of yourself! Your mental health matters. Create a self-care routine and make use of mental health resources available to you.

How to Calculate Your Debt

There are many avenues for paying for college, and you may not need to accept every loan offered to you, so carefully evaluate your options to determine how much debt makes sense. And checkout the other options such as college scholarships for high schoolers. Pay attention to:

- the interest rate

- when the loan is due

- whether you need a cosigner

- options for deferred payment or forgiveness

Types of Student Loans

There are many types of student loans, and it may seem overwhelming to see a giant list on your financial aid statement, so let me break the most common ones down for you. As a rule of thumb, the best kinds of loans, or the most recommended, are federal loans because they come from a trusted source and usually have decent interest rates.

Remember: you do not have to accept every loan offered in your financial aid statement. Learn about each type of loan thoroughly, choose what fits your needs the most, and consider how much debt you are willing to take on.

Federal Subsidized Student Loans

- Come from filling out FAFSA, based on financial need

- Fixed interest rate

- Limited amount

- Government pays your interest while you are in school

Federal Unsubsidized Student Loans

- Come from filling out FAFSA, not based on financial need

- Fixed interest rate

- Limited amount

- Start owing interest as soon as loan is disbursed

Parent PLUS Loans

- Unlimited amount, usually covers what is left after the previous two

- Higher interest rates than other federal loans

- Parents are responsible for paying these off rather than the student

Independent Loans

- Vary greatly from company to company

- May need a cosigner

- Usually much higher interest rates

- Here are some examples of private loans

Using Loan Calculators

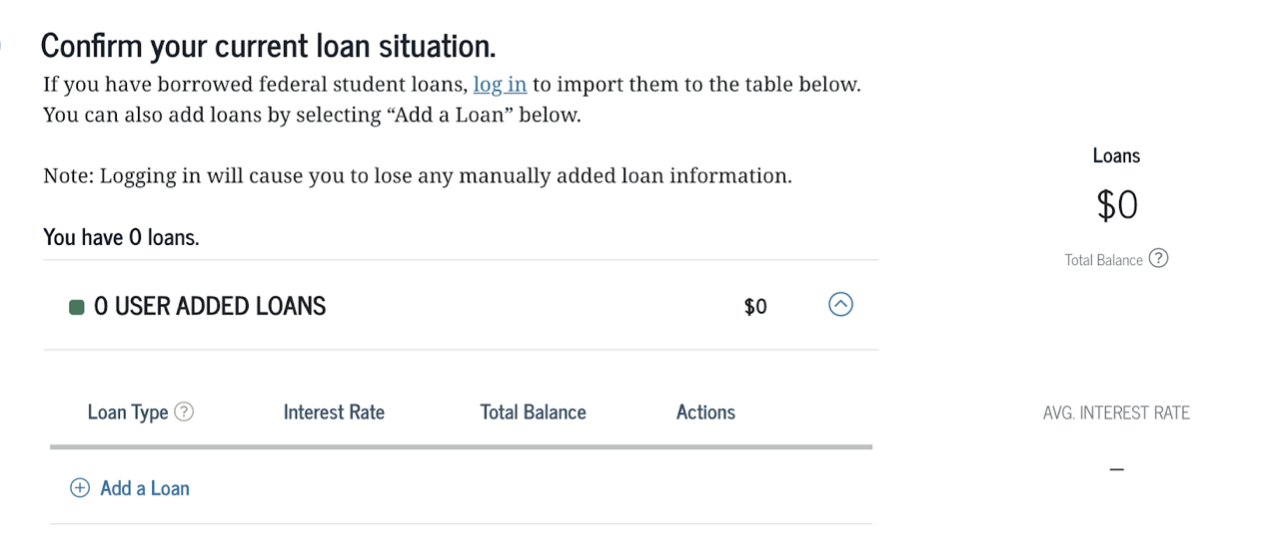

Loan calculators and self-made spreadsheets are a great way to visualize the domino effect that these numbers on a screen can have on your future. After you add up all the loans you think you are willing to accept and their interest rates, hop on over to one of the calculators created by the US Government. Check out this calculator for financial need as well.

There are various other calculators available online that can help you get into the nitty-gritty details of each and every number and possibility for you.

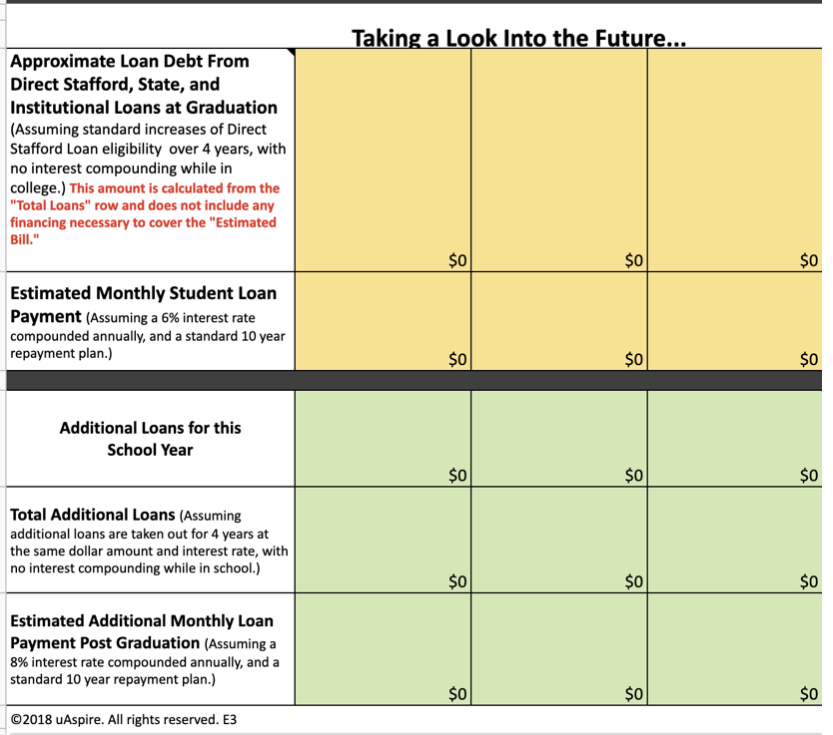

Another way to organize your information is through spreadsheets. UAspire has one that will help you analyze your financial aid, loans, and loan payments. Feel free to take inspiration from this one or create your own that fits your needs. It's incredibly useful to keep all this important information stored somewhere safe and easily accessible.

Looking into the Future

Career Outlook

While you should pick a career you enjoy, you must also evaluate projected salaries when deciding how much student loan debt you are willing to take on. You can use this government site to find out more information about any potential career(s) that may interest you. Remember to use the starting salary!

Having an insanely high starting salary may not always be a great justification for more debt, so look for expert opinions in your desired field. This calculator shows the minimum annual salary in order to handle the loan debt you may be considering.

Steps for Considering Career Fit with Debt:

- Determine Annual Entry Salary for your current career goal

- Use this annual salary to determine monthly salary

- Take around 10% (as a common rule of thumb) of your monthly salary and compare it to your suggested monthly payment for all your student loans combined

- If your monthly payment is greater than that amount, perhaps reconsider the school if you are a pre-frosh or look at other loan options

- Don’t forget to consider what type of lifestyle you want to have after college and how long you are willing to handle debt

Considerations for Pre-Professional Students

As a Pre Professional student, you may be looking at many more years of school ahead of you. It is crucial to consider the cost of graduate programs when deciding the amount of debt you are willing to go into in your undergraduate program. It may be better, in the long run, to go to a cheaper school in order to afford the next step in your career.

Alternative Options to Reduce Student Loan Debt

- Consider Federal Work-Study or getting a campus job while studying

- Try finding paid internships or summer jobs to help pay off loans early!

- Apply to every scholarship you see! No matter how small, any scholarship helps - Check out this guide on how to get scholarships and the college scholarship search process.

- Appeal financial aid at your school with valid reasoning about its affordability for your family. - Learn all about the FAFSA Debt is a scary topic to think and talk about, but don't be afraid to ask questions from your school's financial aid counselor and other people around you!